新聞内容

家事移工可由雇主申報自願參加勞保

依勞工保險條例規定,受僱於第6條第1項各款規定各業以外之員工(如家事移工),可由雇主申報自願參加勞工保險,保險費由雇主負擔70%、勞工負擔20%及政府補助10%,在保期間發生普通事故,即可享有傷病、失能、死亡、生育及老年等給付保障。

換言之,家事移工可由雇主申報自願參加勞工保險,保障其在臺工作期間之普通事故安全,只要雇主及移工每月負擔一些保費,可分散雇主依法對移工負有之照顧管理責任及風險,當移工發生意外死亡或罹患重大傷病導致失能時,均可即時申請給付,提供移工及其家屬經濟生活保障,並有效減輕雇主照顧壓力。

【注意事項】

以目前家事移工薪資每月2萬元適用第1等級投保薪資28,590元計算

雇主每月應負擔勞工保險費為2,355元(含勞保費2,301元、職災保險費54元)

移工每月應負擔勞工保險費為658元,由雇主扣、收繳後,一併向保險人(勞保局)繳納

【案例】

看護移工阿梅發現自己的右胸長了不明腫塊,經醫師診斷罹患乳癌,住院14日

接受切除右乳之手術治療。

出院後阿梅透過雇主協助,向勞保局同時申請勞保傷病給付及失能給付,

經勞保局審查核給阿梅勞保給付合計6萬2,422元,計算方式如下:

傷病給付5,242元

自阿梅住院之第4日起至出院日止,按阿梅發生事故前6個月平均日投保薪資953元(以每月2萬元薪資適用第1級平均月投保薪資28,590元除以30 )*50%*給付11日傷病給付計5,242元

失能給付57,180元

失能程度符合失能給付標準附表第7-44項第13等級,按阿梅診斷失能時前6個月平均日投保薪資953元,發給60日失能給付計57,180元

換言之,家事移工可由雇主申報自願參加勞工保險,保障其在臺工作期間之普通事故安全,只要雇主及移工每月負擔一些保費,可分散雇主依法對移工負有之照顧管理責任及風險,當移工發生意外死亡或罹患重大傷病導致失能時,均可即時申請給付,提供移工及其家屬經濟生活保障,並有效減輕雇主照顧壓力。

【注意事項】

以目前家事移工薪資每月2萬元適用第1等級投保薪資28,590元計算

雇主每月應負擔勞工保險費為2,355元(含勞保費2,301元、職災保險費54元)

移工每月應負擔勞工保險費為658元,由雇主扣、收繳後,一併向保險人(勞保局)繳納

【案例】

看護移工阿梅發現自己的右胸長了不明腫塊,經醫師診斷罹患乳癌,住院14日

接受切除右乳之手術治療。

出院後阿梅透過雇主協助,向勞保局同時申請勞保傷病給付及失能給付,

經勞保局審查核給阿梅勞保給付合計6萬2,422元,計算方式如下:

傷病給付5,242元

自阿梅住院之第4日起至出院日止,按阿梅發生事故前6個月平均日投保薪資953元(以每月2萬元薪資適用第1級平均月投保薪資28,590元除以30 )*50%*給付11日傷病給付計5,242元

失能給付57,180元

失能程度符合失能給付標準附表第7-44項第13等級,按阿梅診斷失能時前6個月平均日投保薪資953元,發給60日失能給付計57,180元

圖片集

ผใชแรงงานในครวเรอน สามารถใหนายจางยนขอ เขารวมประกนภยแรงงานโดยสมครใจได

ตามกฎหมายประกนภยแรงงาน ลกจางททำงานนอกเหนอจากทระบไวในมาตรา 6 วรรค 1 (เชน ผอนบาลในคร

วเรอน) สามารถใหนายจางสมครเขารวมประกนภยแรงงานโดยสมครใจได สดสวนการจายเบยประกน : นายจา

งรบผดชอบ 70% แรงงานจาย 20% และรฐบาลสมทบให 10% ในระหวางประกน หากเกดอบตเหตทวไปขน

แรงงานจะไดรบการคมครองกรณเจบปวย ทพพลภาพ เสยชวต คลอดบตรและบำเหนจชราภาพ ฯลฯ

หรออกนยหนง ผอนบาลในครวเรอนสามารถใหนายจางยนสมครเขารวมประกนภยแรงงานโดยสมครใจ

เพอคมครองความปลอดภยจากอบตเหตทวไป แตละเดอนนายจางและแรงงานจายเบยประกนเพยงเลกนอย สา

มารถกระจายภาระหนาทและความเสยงทนายจางตองรบผดชอบได หากเสยชวตกะทนหนหรอเจบปวยรายแรง

จนเปนเหตใหทพพลภาพ กสามารถยนขอรบเงนชดเชยไดทนท ชวยรบประกนความมนคงทางการเงนของแรงงา

นและครอบครว และชวยลดภาระการดแลของนายจางไดอยางมประสทธภาพ

ขอควรระวง

คำนวณจากเงนเดอนผอนบาลในครวเรอนในปจจบน 20,000 เหรยญ เขาขายเอาประกนในวงเงนประกนชนท 1

คอ 28,590 เหรยญ นายจางรบผดชอบเบยประกน 2,355 เหรยญตอเดอน (ประกอบดวยเบยประกนภยแรงงาน

2,301 เหรยญและเบยประกนอบตเหตจากการทำงาน 54 เหรยญ) ตวแรงงานเองจายเบยประกน 658 เหรยญ โ

ดยนายจางหกจากเงนเดอนแลวนำสงกองทนประกนภยแรงงาน

กรณตวอยาง

อาเหมย ผอนบาลในครวเรอนพบกอนเนอผดปกตบรเวณเตานมขวา หลงแพทยตรวจวนจฉยพบเปนมะเรง

เตานม ตองเขารบการผาตดตดเตานมขวาออก พรอมพกรกษาตวในโรงพยาบาลเปนเวลา 14 วน

หลงออกจากโรงพยาบาล อาเหมยไดยนคำรองขอรบเงนชดเชยกรณเจบปวยและทพพลภาพ โดยนายจาง

ชวยดำเนนการ กองทนฯ ไดอนมตเงนชดเชยรวม 62,422 เหรยญไตหวน โดยมรายละเอยดดงน:

คาชดเชยกรณเจบปวย : 5,242 เหรยญไตหวน

คำนวณจากวนท 4 ของการเขารบการรกษาจนถงวนออกจากโรงพยาบาล คดตามวงเงนประ

กนเฉลยรายวนในชวง 6 เดอนกอนเกดเหต เทากบ 953 เหรยญ (คาจาง 20,000 เหรยญ เขา

ขายเอาประกนในวงเงนประกนชนท 1 คอ 28,590 เหรยญ หารดวย 30 วน) × 50% × 11

วน = 5,242 เหรยญไตหวน

คาชดเชยกรณทพพลภาพ : 57,180 เหรยญไตหวน

ระดบความทพพลภาพตรงตามมาตรฐานคาชดเชยขอ 7-44 ระดบท 13 จะไดรบคา

ชดเชย 60 วนของวงเงนประกนรายวนกอนเกดเหต 6 เดอน เทากบ 953 เหรยญ ×

60 วน = 57,180 เหรยญไตหวน

วเรอน) สามารถใหนายจางสมครเขารวมประกนภยแรงงานโดยสมครใจได สดสวนการจายเบยประกน : นายจา

งรบผดชอบ 70% แรงงานจาย 20% และรฐบาลสมทบให 10% ในระหวางประกน หากเกดอบตเหตทวไปขน

แรงงานจะไดรบการคมครองกรณเจบปวย ทพพลภาพ เสยชวต คลอดบตรและบำเหนจชราภาพ ฯลฯ

หรออกนยหนง ผอนบาลในครวเรอนสามารถใหนายจางยนสมครเขารวมประกนภยแรงงานโดยสมครใจ

เพอคมครองความปลอดภยจากอบตเหตทวไป แตละเดอนนายจางและแรงงานจายเบยประกนเพยงเลกนอย สา

มารถกระจายภาระหนาทและความเสยงทนายจางตองรบผดชอบได หากเสยชวตกะทนหนหรอเจบปวยรายแรง

จนเปนเหตใหทพพลภาพ กสามารถยนขอรบเงนชดเชยไดทนท ชวยรบประกนความมนคงทางการเงนของแรงงา

นและครอบครว และชวยลดภาระการดแลของนายจางไดอยางมประสทธภาพ

ขอควรระวง

คำนวณจากเงนเดอนผอนบาลในครวเรอนในปจจบน 20,000 เหรยญ เขาขายเอาประกนในวงเงนประกนชนท 1

คอ 28,590 เหรยญ นายจางรบผดชอบเบยประกน 2,355 เหรยญตอเดอน (ประกอบดวยเบยประกนภยแรงงาน

2,301 เหรยญและเบยประกนอบตเหตจากการทำงาน 54 เหรยญ) ตวแรงงานเองจายเบยประกน 658 เหรยญ โ

ดยนายจางหกจากเงนเดอนแลวนำสงกองทนประกนภยแรงงาน

กรณตวอยาง

อาเหมย ผอนบาลในครวเรอนพบกอนเนอผดปกตบรเวณเตานมขวา หลงแพทยตรวจวนจฉยพบเปนมะเรง

เตานม ตองเขารบการผาตดตดเตานมขวาออก พรอมพกรกษาตวในโรงพยาบาลเปนเวลา 14 วน

หลงออกจากโรงพยาบาล อาเหมยไดยนคำรองขอรบเงนชดเชยกรณเจบปวยและทพพลภาพ โดยนายจาง

ชวยดำเนนการ กองทนฯ ไดอนมตเงนชดเชยรวม 62,422 เหรยญไตหวน โดยมรายละเอยดดงน:

คาชดเชยกรณเจบปวย : 5,242 เหรยญไตหวน

คำนวณจากวนท 4 ของการเขารบการรกษาจนถงวนออกจากโรงพยาบาล คดตามวงเงนประ

กนเฉลยรายวนในชวง 6 เดอนกอนเกดเหต เทากบ 953 เหรยญ (คาจาง 20,000 เหรยญ เขา

ขายเอาประกนในวงเงนประกนชนท 1 คอ 28,590 เหรยญ หารดวย 30 วน) × 50% × 11

วน = 5,242 เหรยญไตหวน

คาชดเชยกรณทพพลภาพ : 57,180 เหรยญไตหวน

ระดบความทพพลภาพตรงตามมาตรฐานคาชดเชยขอ 7-44 ระดบท 13 จะไดรบคา

ชดเชย 60 วนของวงเงนประกนรายวนกอนเกดเหต 6 เดอน เทากบ 953 เหรยญ ×

60 วน = 57,180 เหรยญไตหวน

Chủ thuê có thể giúp Lao động gia đình đăng ký Tham gia Bảo hiểm Lao động tự nguyện

Theo quy định của Điều lệ Bảo hiểm Lao động, người lao động làm việc trong các ngành nghề khác ngoài ngành nghề

quy định tại khoản 1, Điều 6 (như người lao động làm việc tại gia đình) có thể do người sử dụng lao động nộp đơn xin

tham gia bảo hiểm lao động tự nguyện. Phí bảo hiểm do người sử dụng lao động chịu 70%, người lao động chịu 20% và

chính phủ chịu 10%. Nếu xảy ra tai nạn thông thường trong thời gian bảo hiểm, có thể được hưởng các chế độ như

thương tật, tàn tật, tử vong, sinh con và tuổi già.

Nói cách khác, người lao động làm việc tại gia đình có thể tham gia bảo hiểm lao động tự nguyện thông qua người sử

dụng lao động của họ để được đảm bảo an toàn trước những tai nạn thường gặp khi làm việc tại Đài Loan. Chỉ cần

người sử dụng lao động và người lao động nhập cư đóng một số phí bảo hiểm hàng tháng, trách nhiệm pháp lý và rủi ro

chăm sóc người lao động nhập cư của người sử dụng lao động có thể được phân tán. Khi người lao động nhập cư tử

vong do tai nạn hoặc bị thương hoặc mắc bệnh nghiêm trọng gây ra tình trạng tàn tật, người sử dụng lao động có thể

nộp đơn xin thanh toán ngay lập tức, mang lại sự an toàn kinh tế cho người lao động nhập cư và gia đình của họ, đồng

thời giảm hiệu quả áp lực chăm sóc cho người sử dụng lao động.

【Những điều cầu lưu ý】

Căn cứ vào mức lương tháng hiện tại là 20.000 Đài tệ của lao động gia đình, sẽ được áp dụng với mức lương bảo hiểm bậc một là 28.590 Đài tệ.

Phí bảo hiểm lao động hàng tháng mà người sử dụng lao động phải chịu là 2.355 Đài tệ (bao gồm 2.301 Đài tệ cho bảo hiểm lao động và 54 Đài tệ cho bảo hiểm tai nạn lao động).

Phí bảo hiểm lao động hàng tháng mà người lao động nhập cư phải chịu là 658 Đài tệ, số tiền này sẽ được người sử dụng lao động khấu trừ hoặc thu trước, sau đó trả cho bên bảo hiểm (Cục Bảo hiểm Lao động).

【 Tình huống 】

Khán hộ công Mai phát hiện mình có một khối u ở vú phải. Cô được bác sĩ chẩn đoán mắc ung

thư vú và phải nằm viện 14 ngày để phẫu thuật cắt bỏ vú phải. Sau khi xuất viện, với sự giúp

đỡ của người sử dụng lao động, Mai đã nộp đơn xin hưởng chế độ thương tật và tàn tật với Cục

Bảo hiểm Lao động. Sau khi được Cục Bảo hiểm Lao động xem xét, Mai đã được trao tổng

cộng 62.422 Đài tệ tiền trợ cấp bảo hiểm lao động, cách tính như sau:

Trợ cấp thương tật 5.242 Đài tệ

Từ ngày thứ 4 Mai nằm viện đến ngày xuất viện, mức lương bảo hiểm trung bình hàng ngày của

Mai là 953 Đài tệ trong 6 tháng trước khi xảy ra tai nạn (dựa trên mức lương hàng tháng là

20.000 Đài tệ, mức lương bảo hiểm trung bình hàng tháng cấp một là 28.590 Đài tệ chia cho

30) * 50% * 11 ngày trợ cấp thương, bệnh tật tổng cộng là 5.242 Đài tệ.

Trợ cấp tàn tật 57.180 Đài tệ

Mức độ khuyết tật đạt đến mức 13 của mục 7-44 trong Phụ lục Tiêu chuẩn Trợ cấp

Khuyết tật. Dựa trên mức lương trung bình hàng ngày được bảo hiểm là 953 Đài tệ

trong sáu tháng trước khi Mai được chẩn đoán bị khuyết tật, chi trả trợ cấp khuyết tật

trong 60 ngày là 57.180 Đài tệ.

quy định tại khoản 1, Điều 6 (như người lao động làm việc tại gia đình) có thể do người sử dụng lao động nộp đơn xin

tham gia bảo hiểm lao động tự nguyện. Phí bảo hiểm do người sử dụng lao động chịu 70%, người lao động chịu 20% và

chính phủ chịu 10%. Nếu xảy ra tai nạn thông thường trong thời gian bảo hiểm, có thể được hưởng các chế độ như

thương tật, tàn tật, tử vong, sinh con và tuổi già.

Nói cách khác, người lao động làm việc tại gia đình có thể tham gia bảo hiểm lao động tự nguyện thông qua người sử

dụng lao động của họ để được đảm bảo an toàn trước những tai nạn thường gặp khi làm việc tại Đài Loan. Chỉ cần

người sử dụng lao động và người lao động nhập cư đóng một số phí bảo hiểm hàng tháng, trách nhiệm pháp lý và rủi ro

chăm sóc người lao động nhập cư của người sử dụng lao động có thể được phân tán. Khi người lao động nhập cư tử

vong do tai nạn hoặc bị thương hoặc mắc bệnh nghiêm trọng gây ra tình trạng tàn tật, người sử dụng lao động có thể

nộp đơn xin thanh toán ngay lập tức, mang lại sự an toàn kinh tế cho người lao động nhập cư và gia đình của họ, đồng

thời giảm hiệu quả áp lực chăm sóc cho người sử dụng lao động.

【Những điều cầu lưu ý】

Căn cứ vào mức lương tháng hiện tại là 20.000 Đài tệ của lao động gia đình, sẽ được áp dụng với mức lương bảo hiểm bậc một là 28.590 Đài tệ.

Phí bảo hiểm lao động hàng tháng mà người sử dụng lao động phải chịu là 2.355 Đài tệ (bao gồm 2.301 Đài tệ cho bảo hiểm lao động và 54 Đài tệ cho bảo hiểm tai nạn lao động).

Phí bảo hiểm lao động hàng tháng mà người lao động nhập cư phải chịu là 658 Đài tệ, số tiền này sẽ được người sử dụng lao động khấu trừ hoặc thu trước, sau đó trả cho bên bảo hiểm (Cục Bảo hiểm Lao động).

【 Tình huống 】

Khán hộ công Mai phát hiện mình có một khối u ở vú phải. Cô được bác sĩ chẩn đoán mắc ung

thư vú và phải nằm viện 14 ngày để phẫu thuật cắt bỏ vú phải. Sau khi xuất viện, với sự giúp

đỡ của người sử dụng lao động, Mai đã nộp đơn xin hưởng chế độ thương tật và tàn tật với Cục

Bảo hiểm Lao động. Sau khi được Cục Bảo hiểm Lao động xem xét, Mai đã được trao tổng

cộng 62.422 Đài tệ tiền trợ cấp bảo hiểm lao động, cách tính như sau:

Trợ cấp thương tật 5.242 Đài tệ

Từ ngày thứ 4 Mai nằm viện đến ngày xuất viện, mức lương bảo hiểm trung bình hàng ngày của

Mai là 953 Đài tệ trong 6 tháng trước khi xảy ra tai nạn (dựa trên mức lương hàng tháng là

20.000 Đài tệ, mức lương bảo hiểm trung bình hàng tháng cấp một là 28.590 Đài tệ chia cho

30) * 50% * 11 ngày trợ cấp thương, bệnh tật tổng cộng là 5.242 Đài tệ.

Trợ cấp tàn tật 57.180 Đài tệ

Mức độ khuyết tật đạt đến mức 13 của mục 7-44 trong Phụ lục Tiêu chuẩn Trợ cấp

Khuyết tật. Dựa trên mức lương trung bình hàng ngày được bảo hiểm là 953 Đài tệ

trong sáu tháng trước khi Mai được chẩn đoán bị khuyết tật, chi trả trợ cấp khuyết tật

trong 60 ngày là 57.180 Đài tệ.

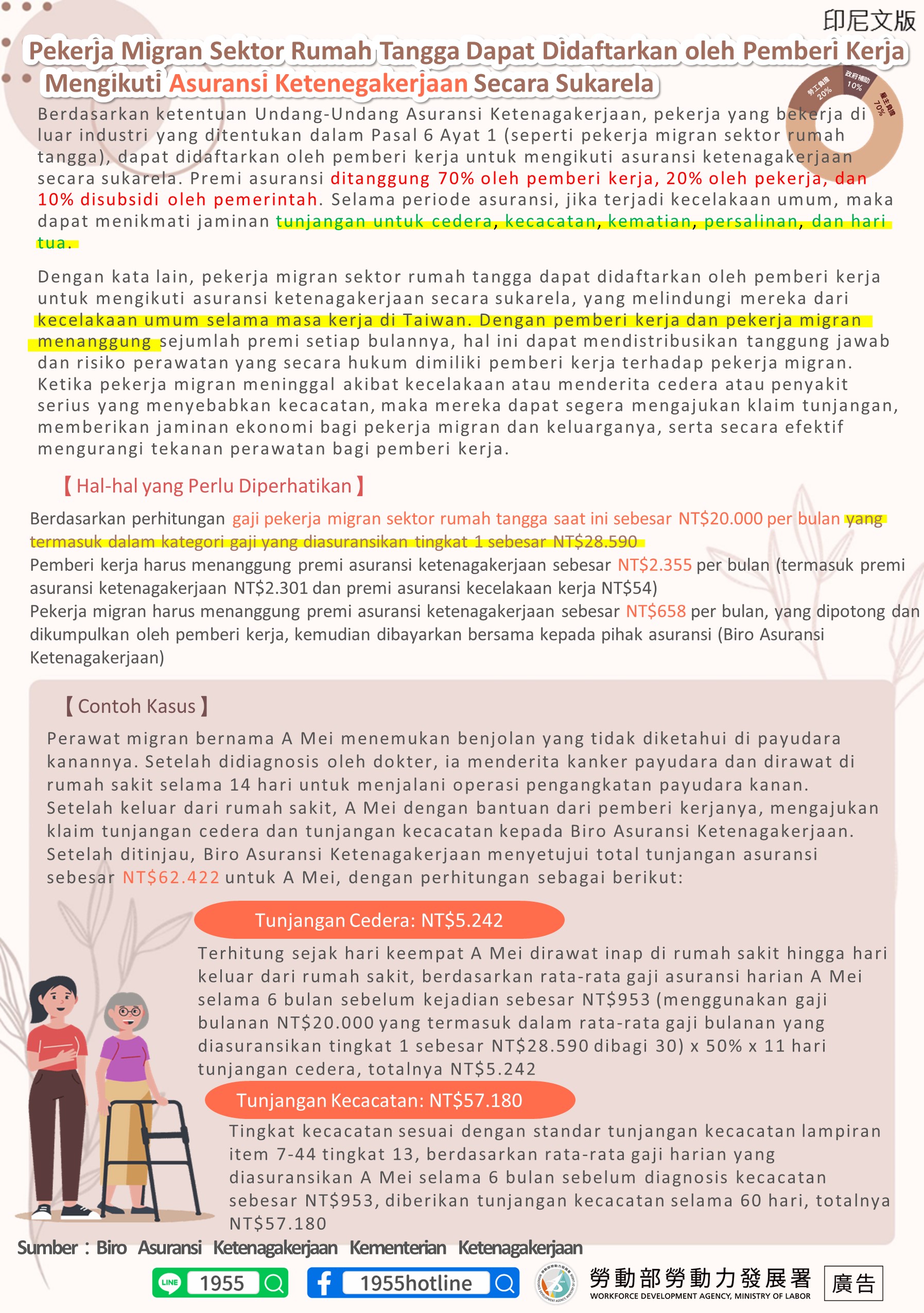

Pekerja Migran Sektor Rumah Tangga Dapat Didaftarkan oleh Pemberi Kerja Mengikuti Asuransi Ketenegakerjaan Secara Sukarela

Berdasarkan ketentuan Undang-Undang Asuransi Ketenagakerjaan, pekerja yang bekerja di luar industri yang ditentukan dalam Pasal 6 Ayat 1 (seperti pekerja migran sektor rumah tangga), dapat didaftarkan oleh pemberi kerja untuk mengikuti asuransi ketenagakerjaan secara sukarela. Premi asuransi ditanggung 70% oleh pemberi kerja, 20% oleh pekerja, dan 10% disubsidi oleh pemerintah. Selama periode asuransi, jika terjadi kecelakaan umum, maka dapat menikmati jaminan tunjangan untuk cedera, kecacatan, kematian, persalinan, dan hari tua.

Dengan kata lain, pekerja migran sektor rumah tangga dapat didaftarkan oleh pemberi kerja untuk mengikuti asuransi ketenagakerjaan secara sukarela, yang melindungi mereka dari kecelakaan umum selama masa kerja di Taiwan. Dengan pemberi kerja dan pekerja migran menanggung sejumlah premi setiap bulannya, hal ini dapat mendistribusikan tanggung jawab dan risiko perawatan yang secara hukum dimiliki pemberi kerja terhadap pekerja migran. Ketika pekerja migran meninggal akibat kecelakaan atau menderita cedera atau penyakit serius yang menyebabkan kecacatan, maka mereka dapat segera mengajukan klaim tunjangan, memberikan jaminan ekonomi bagi pekerja migran dan keluarganya, serta secara efektif mengurangi tekanan perawatan bagi pemberi kerja.

【Hal-hal yang Perlu Diperhatikan】

Berdasarkan perhitungan gaji pekerja migran sektor rumah tangga saat ini sebesar NT$20.000 per bulan yang termasuk dalam kategori gaji yang diasuransikan tingkat 1 sebesar NT$28.590

Pemberi kerja harus menanggung premi asuransi ketenagakerjaan sebesar NT$2.355 per bulan (termasuk premi asuransi ketenagakerjaan NT$2.301 dan premi asuransi kecelakaan kerja NT$54)

Pekerja migran harus menanggung premi asuransi ketenagakerjaan sebesar NT$658 per bulan, yang dipotong dan dikumpulkan oleh pemberi kerja, kemudian dibayarkan bersama kepada pihak asuransi (Biro Asuransi Ketenagakerjaan)

【Contoh Kasus】

Perawat migran bernama A Mei menemukan benjolan yang tidak diketahui di payudara kanannya. Setelah didiagnosis oleh dokter, ia menderita kanker payudara dan dirawat di rumah sakit selama 14 hari untuk menjalani operasi pengangkatan payudara kanan.

Setelah keluar dari rumah sakit, A Mei dengan bantuan dari pemberi kerjanya, mengajukan klaim tunjangan cedera dan tunjangan kecacatan kepada Biro Asuransi Ketenagakerjaan. Setelah ditinjau, Biro Asuransi Ketenagakerjaan menyetujui total tunjangan asuransi sebesar NT$62.422 untuk A Mei, dengan perhitungan sebagai berikut:

Tunjangan Cedera: NT$5.242

Terhitung sejak hari keempat A Mei dirawat inap di rumah sakit hingga hari keluar dari rumah sakit, berdasarkan rata-rata gaji asuransi harian A Mei selama 6 bulan sebelum kejadian sebesar NT$953 (menggunakan gaji bulanan NT$20.000 yang termasuk dalam rata-rata gaji bulanan yang diasuransikan tingkat 1 sebesar NT$28.590 dibagi 30) x 50% x 11 hari tunjangan cedera, totalnya NT$5.242

Tunjangan Kecacatan: NT$57.180

Tingkat kecacatan sesuai dengan standar tunjangan kecacatan lampiran item 7-44 tingkat 13, berdasarkan rata-rata gaji harian yang diasuransikan A Mei selama 6 bulan sebelum diagnosis kecacatan sebesar NT$953, diberikan tunjangan kecacatan selama 60 hari, totalnya NT$57.180

Dengan kata lain, pekerja migran sektor rumah tangga dapat didaftarkan oleh pemberi kerja untuk mengikuti asuransi ketenagakerjaan secara sukarela, yang melindungi mereka dari kecelakaan umum selama masa kerja di Taiwan. Dengan pemberi kerja dan pekerja migran menanggung sejumlah premi setiap bulannya, hal ini dapat mendistribusikan tanggung jawab dan risiko perawatan yang secara hukum dimiliki pemberi kerja terhadap pekerja migran. Ketika pekerja migran meninggal akibat kecelakaan atau menderita cedera atau penyakit serius yang menyebabkan kecacatan, maka mereka dapat segera mengajukan klaim tunjangan, memberikan jaminan ekonomi bagi pekerja migran dan keluarganya, serta secara efektif mengurangi tekanan perawatan bagi pemberi kerja.

【Hal-hal yang Perlu Diperhatikan】

Berdasarkan perhitungan gaji pekerja migran sektor rumah tangga saat ini sebesar NT$20.000 per bulan yang termasuk dalam kategori gaji yang diasuransikan tingkat 1 sebesar NT$28.590

Pemberi kerja harus menanggung premi asuransi ketenagakerjaan sebesar NT$2.355 per bulan (termasuk premi asuransi ketenagakerjaan NT$2.301 dan premi asuransi kecelakaan kerja NT$54)

Pekerja migran harus menanggung premi asuransi ketenagakerjaan sebesar NT$658 per bulan, yang dipotong dan dikumpulkan oleh pemberi kerja, kemudian dibayarkan bersama kepada pihak asuransi (Biro Asuransi Ketenagakerjaan)

【Contoh Kasus】

Perawat migran bernama A Mei menemukan benjolan yang tidak diketahui di payudara kanannya. Setelah didiagnosis oleh dokter, ia menderita kanker payudara dan dirawat di rumah sakit selama 14 hari untuk menjalani operasi pengangkatan payudara kanan.

Setelah keluar dari rumah sakit, A Mei dengan bantuan dari pemberi kerjanya, mengajukan klaim tunjangan cedera dan tunjangan kecacatan kepada Biro Asuransi Ketenagakerjaan. Setelah ditinjau, Biro Asuransi Ketenagakerjaan menyetujui total tunjangan asuransi sebesar NT$62.422 untuk A Mei, dengan perhitungan sebagai berikut:

Tunjangan Cedera: NT$5.242

Terhitung sejak hari keempat A Mei dirawat inap di rumah sakit hingga hari keluar dari rumah sakit, berdasarkan rata-rata gaji asuransi harian A Mei selama 6 bulan sebelum kejadian sebesar NT$953 (menggunakan gaji bulanan NT$20.000 yang termasuk dalam rata-rata gaji bulanan yang diasuransikan tingkat 1 sebesar NT$28.590 dibagi 30) x 50% x 11 hari tunjangan cedera, totalnya NT$5.242

Tunjangan Kecacatan: NT$57.180

Tingkat kecacatan sesuai dengan standar tunjangan kecacatan lampiran item 7-44 tingkat 13, berdasarkan rata-rata gaji harian yang diasuransikan A Mei selama 6 bulan sebelum diagnosis kecacatan sebesar NT$953, diberikan tunjangan kecacatan selama 60 hari, totalnya NT$57.180

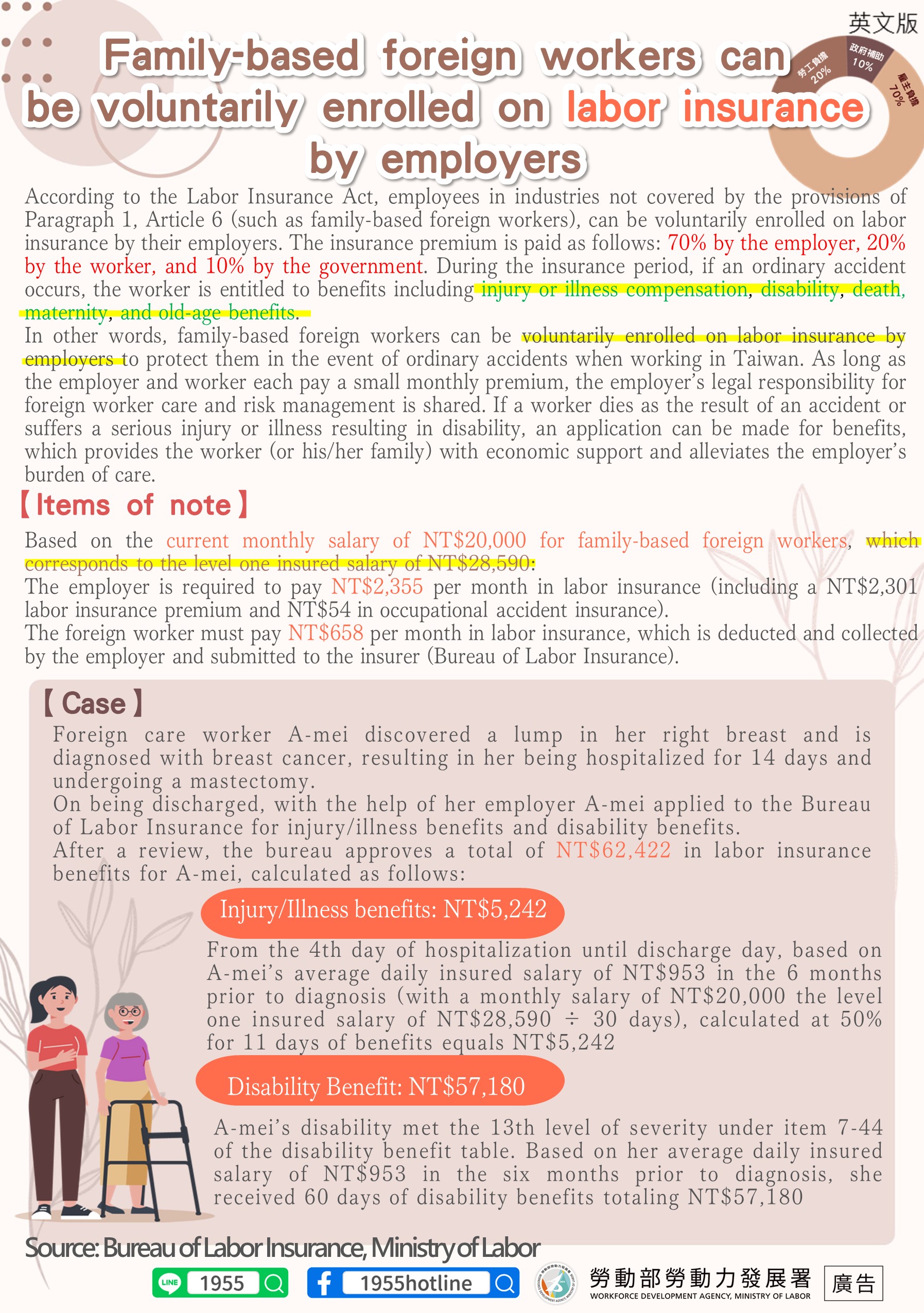

Family-based foreign workers can be voluntarily enrolled on labor insurance by employers

According to the Labor Insurance Act, employees in industries not covered by the provisions of Paragraph 1, Article 6 (such as family-based foreign workers), can be voluntarily enrolled on labor insurance by their employers. The insurance premium is paid as follows: 70% by the employer, 20% by the worker, and 10% by the government. During the insurance period, if an ordinary accident occurs, the worker is entitled to benefits including injury or illness compensation, disability, death, maternity, and old-age benefits.

In other words, family-based foreign workers can be voluntarily enrolled on labor insurance by employers to protect them in the event of ordinary accidents when working in Taiwan. As long as the employer and worker each pay a small monthly premium, the employer’s legal responsibility for foreign worker care and risk management is shared. If a worker dies as the result of an accident or suffers a serious injury or illness resulting in disability, an application can be made for benefits, which provides the worker (or his/her family) with economic support and alleviates the employer’s burden of care.

【Items of note】

Based on the current monthly salary of NT$20,000 for family-based foreign workers, which corresponds to the level one insured salary of NT$28,590:

The employer is required to pay NT$2,355 per month in labor insurance (including a NT$2,301 labor insurance premium and NT$54 in occupational accident insurance).

The foreign worker must pay NT$658 per month in labor insurance, which is deducted and collected by the employer and submitted to the insurer (Bureau of Labor Insurance).

【Case】

Foreign care worker A-mei discovered a lump in her right breast and is diagnosed with breast cancer, resulting in her being hospitalized for 14 days and undergoing a mastectomy.

On being discharged, with the help of her employer A-mei applied to the Bureau of Labor Insurance for injury/illness benefits and disability benefits.

After a review, the bureau approves a total of NT$62,422 in labor insurance benefits for A-mei, calculated as follows:

Injury/Illness benefits: NT$5,242

From the 4th day of hospitalization until discharge day, based on A-mei’s average daily insured salary of NT$953 in the 6 months prior to diagnosis (with a monthly salary of NT$20,000 the level one insured salary of NT$28,590 ÷ 30 days), calculated at 50% for 11 days of benefits equals NT$5,242

Disability Benefit: NT$57,180

A-mei’s disability met the 13th level of severity under item 7-44 of the disability benefit table. Based on her average daily insured salary of NT$953 in the six months prior to diagnosis, she received 60 days of disability benefits totaling NT$57,180

In other words, family-based foreign workers can be voluntarily enrolled on labor insurance by employers to protect them in the event of ordinary accidents when working in Taiwan. As long as the employer and worker each pay a small monthly premium, the employer’s legal responsibility for foreign worker care and risk management is shared. If a worker dies as the result of an accident or suffers a serious injury or illness resulting in disability, an application can be made for benefits, which provides the worker (or his/her family) with economic support and alleviates the employer’s burden of care.

【Items of note】

Based on the current monthly salary of NT$20,000 for family-based foreign workers, which corresponds to the level one insured salary of NT$28,590:

The employer is required to pay NT$2,355 per month in labor insurance (including a NT$2,301 labor insurance premium and NT$54 in occupational accident insurance).

The foreign worker must pay NT$658 per month in labor insurance, which is deducted and collected by the employer and submitted to the insurer (Bureau of Labor Insurance).

【Case】

Foreign care worker A-mei discovered a lump in her right breast and is diagnosed with breast cancer, resulting in her being hospitalized for 14 days and undergoing a mastectomy.

On being discharged, with the help of her employer A-mei applied to the Bureau of Labor Insurance for injury/illness benefits and disability benefits.

After a review, the bureau approves a total of NT$62,422 in labor insurance benefits for A-mei, calculated as follows:

Injury/Illness benefits: NT$5,242

From the 4th day of hospitalization until discharge day, based on A-mei’s average daily insured salary of NT$953 in the 6 months prior to diagnosis (with a monthly salary of NT$20,000 the level one insured salary of NT$28,590 ÷ 30 days), calculated at 50% for 11 days of benefits equals NT$5,242

Disability Benefit: NT$57,180

A-mei’s disability met the 13th level of severity under item 7-44 of the disability benefit table. Based on her average daily insured salary of NT$953 in the six months prior to diagnosis, she received 60 days of disability benefits totaling NT$57,180

2025-08-12 14:25